Our Solutions

Customer retention through education

Most life insurance customers who discontinue their policies do so due to Improper understanding/guidance on potential benefits under their policies and what they lose on discontinuing.

Our in-house contact centre works dedicatedly on behalf of partner insurers for their renewals and retention efforts.

ValuEnable's Content Engine helps quantify these benefits and losses and helps our partner insurers to communicate these benefits via multiple modes to their customers.

Financing

Life insurance as a long term financial asset is often illiquid. However, policyholders have the option to get a low interest loan against their policies without discontinuing and losing out on future benefits.

- For most traditional savings plans, policy loan is available from

the life insurers themselves.

- For most ULIPs, policy loans from insurers are not available

However, in both these cases, the policyholder can take a secured loan against the policy from banks/NBFCs.

Currently, while such loans are available, the overall process is complex, often taking 8-10 days from the initial interest to loan disbursal.

We are solving this with our End-to-End digital, Policy Loan Marketplace, which enables a seamless policy loan issuance from our partner lenders.

Content Engine

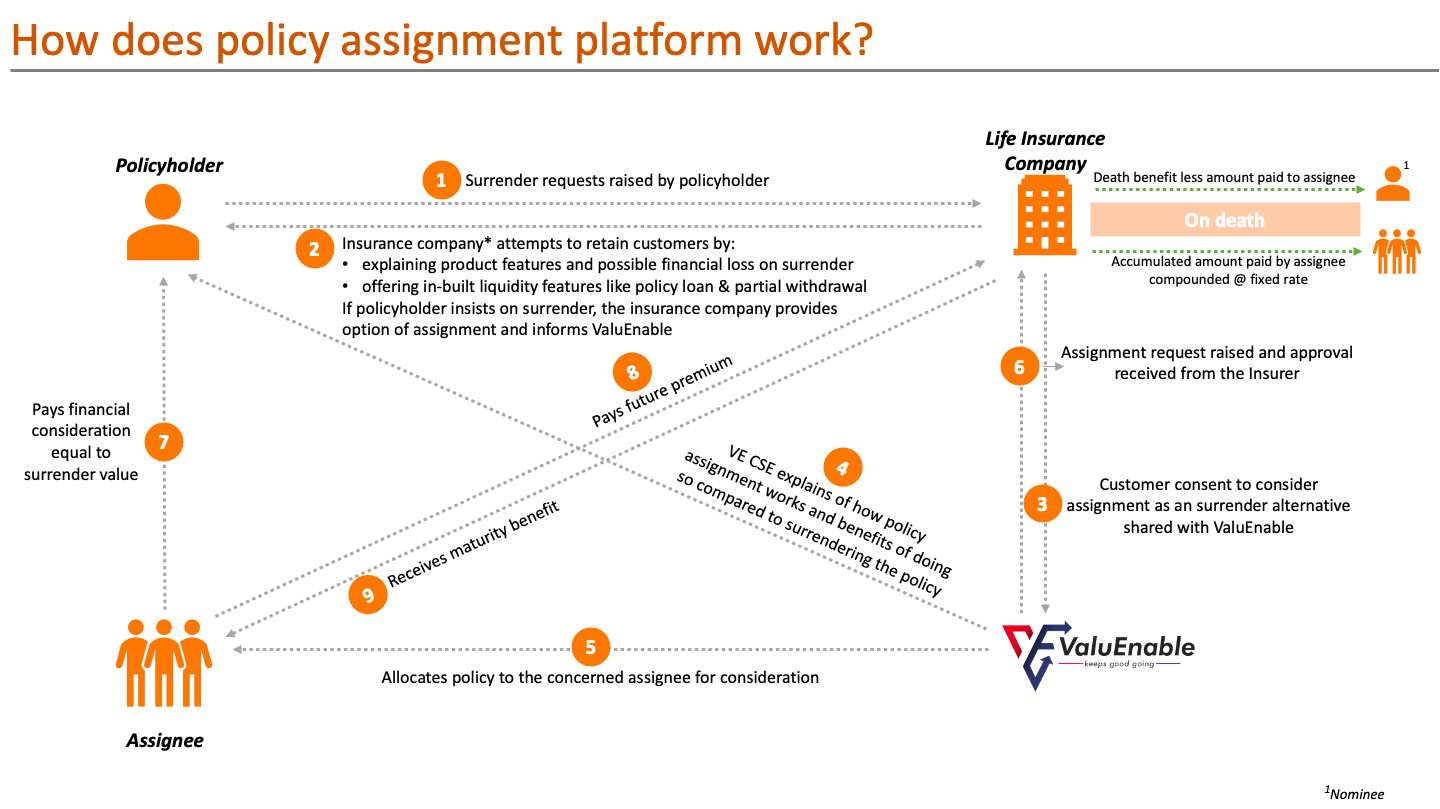

ValuEnable has created India's first Content Engine since January 2022. The platform helps those policyholders who have decided to surrender their policy by providing them with a beneficial alternative in the form of Policy Assignment

- The policyholder receives an amount not less than the surrender value from an external investor (assignee) AND continues to enjoy a part of his/her death benefit, which would have otherwise been lost in case of surrender.

-The investor (assignee) gets the opportunity to invest in a pre-owned policy for the remaining policy term, a safe alternative investment with higher returns than comparable instruments.

The policy remains on the books of the life insurers, boosting retention ratios, effectively making this a win-win proposition for all involved.