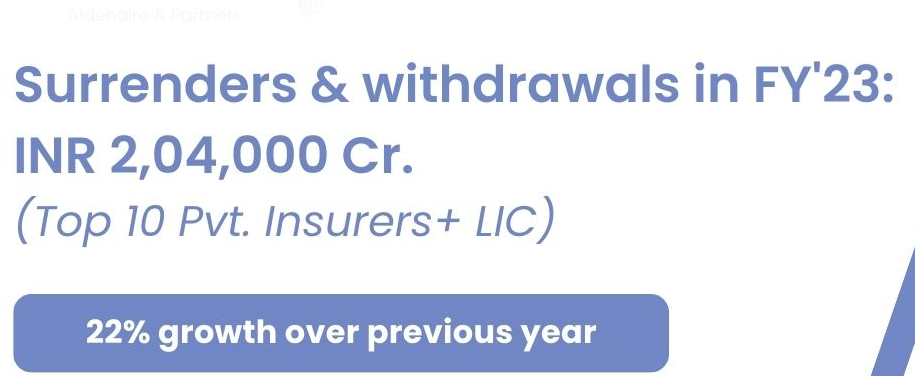

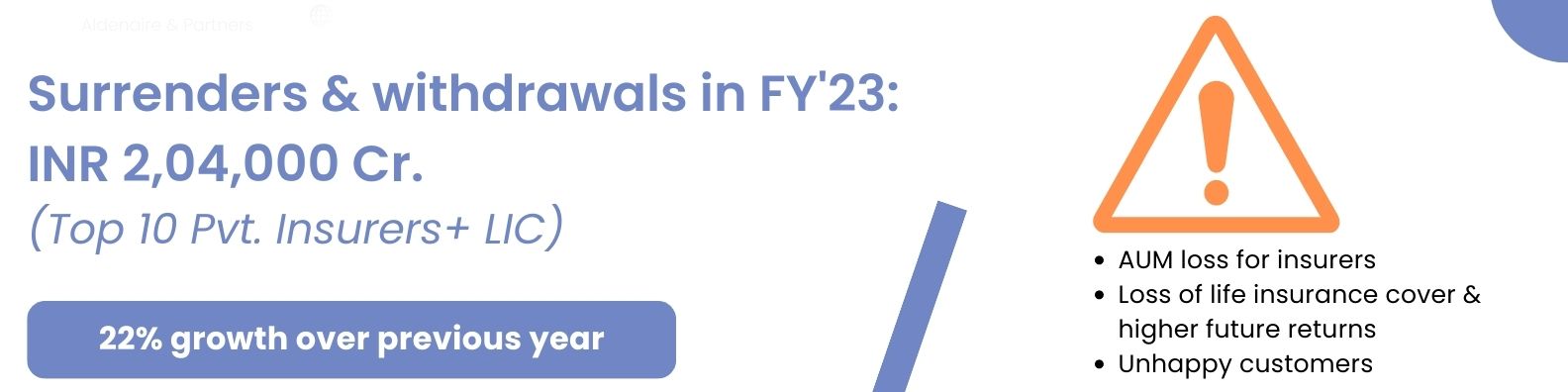

Why ValuEnable?

Our Full Stack Solution

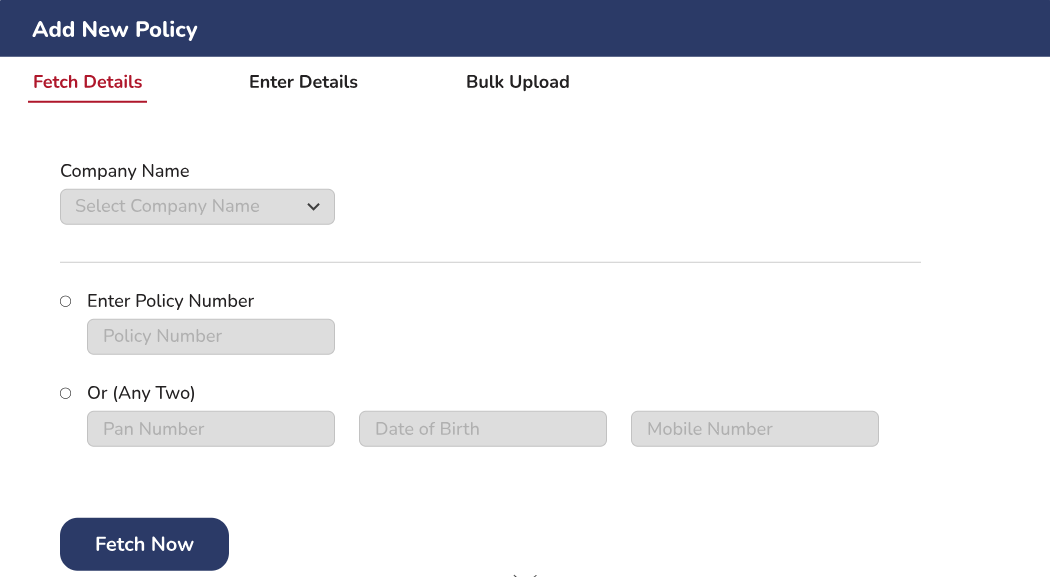

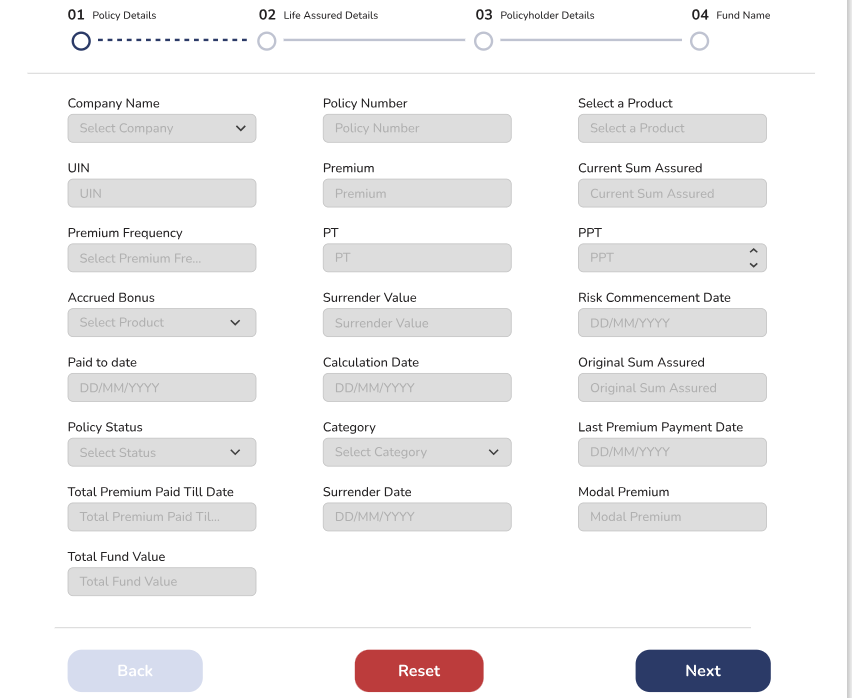

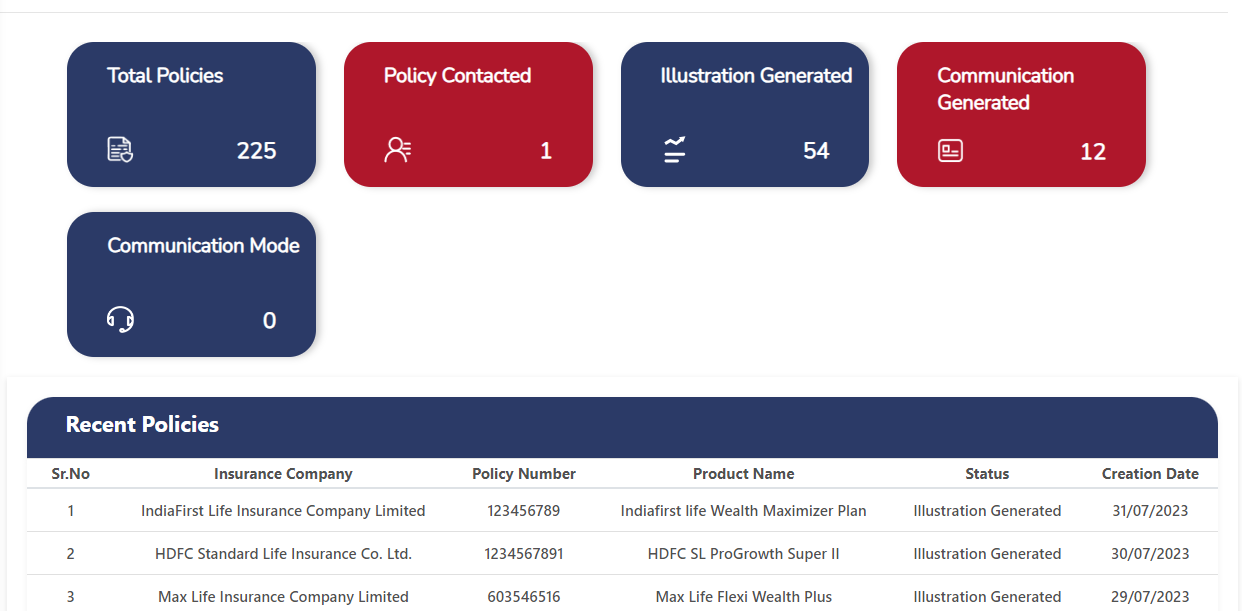

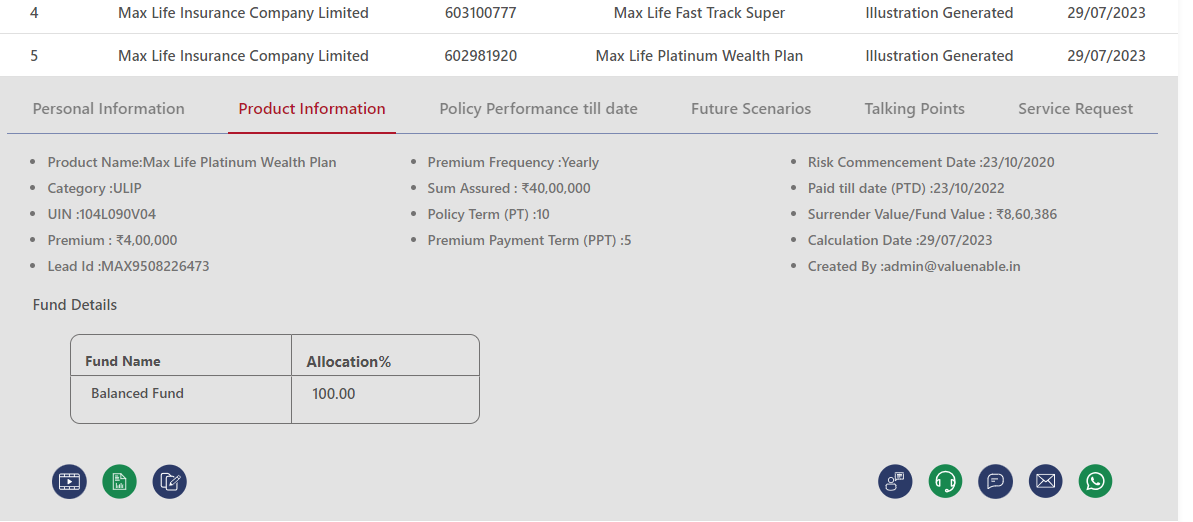

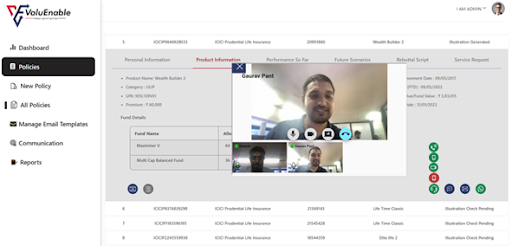

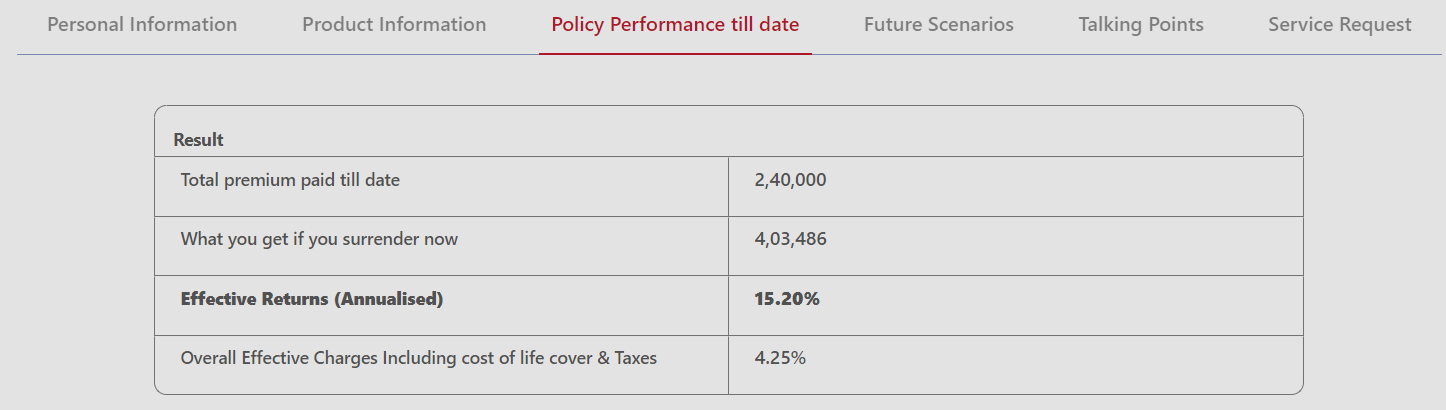

To overcome the customer retention challenges, we’re building a comprehensive solution dedicated to serve existing policyholders and Life insurers through ...

our multi-stack enterprise solution

-

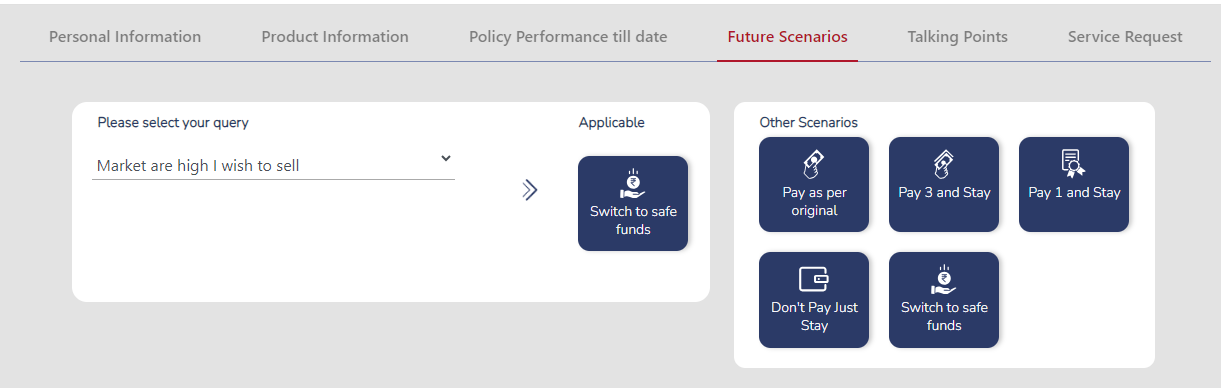

Content & Delivery Stack

Insurers bridge awareness gaps of customers on their policies through simplified, personalised benefit illustration nudges for renewals/retention using our content engine and multi-delivery (voice/video) platform for customer engagement

-

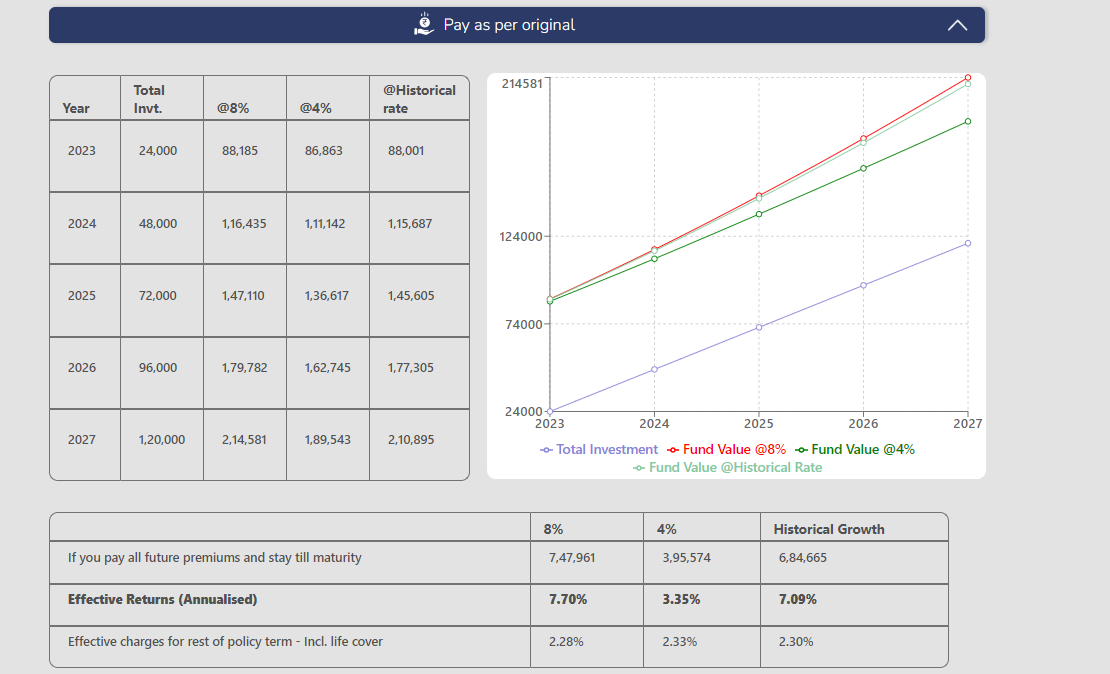

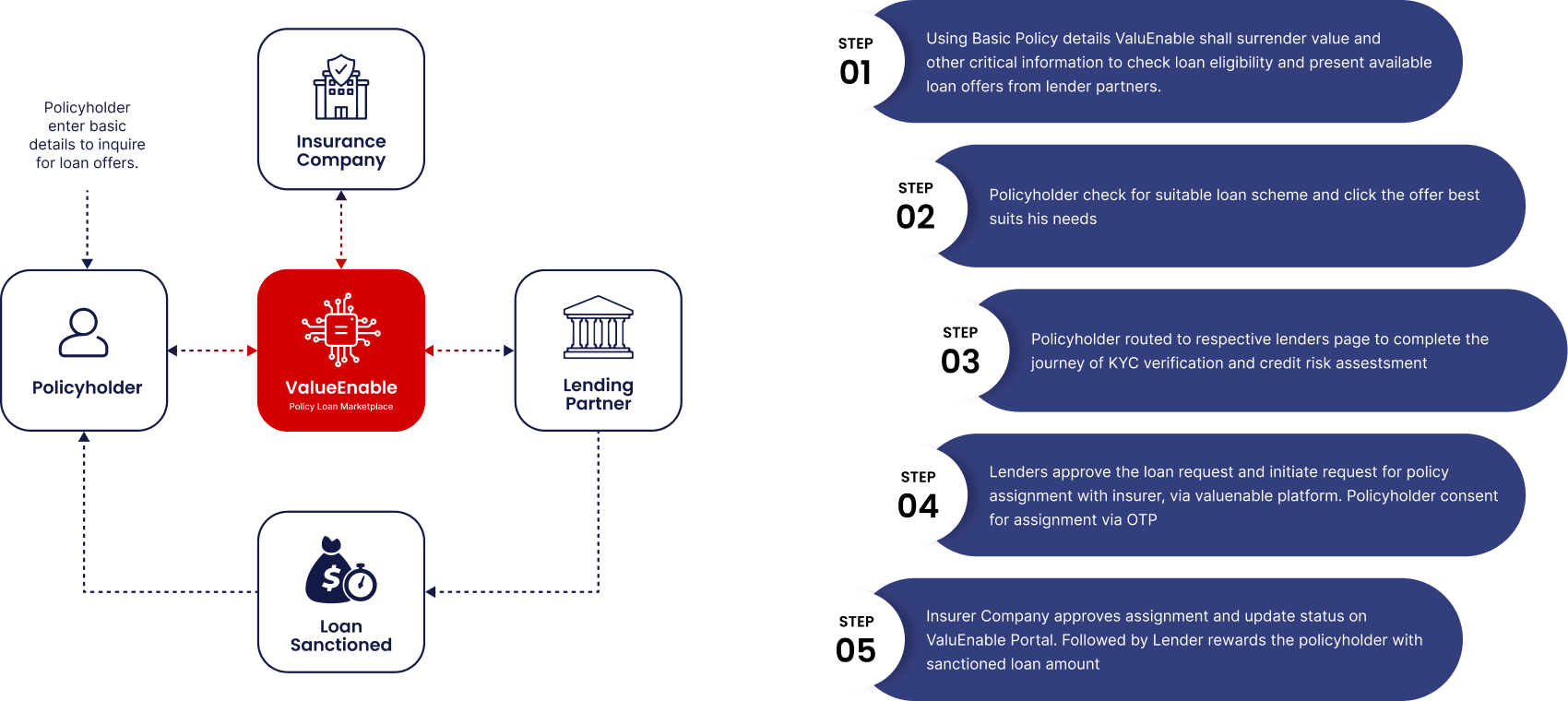

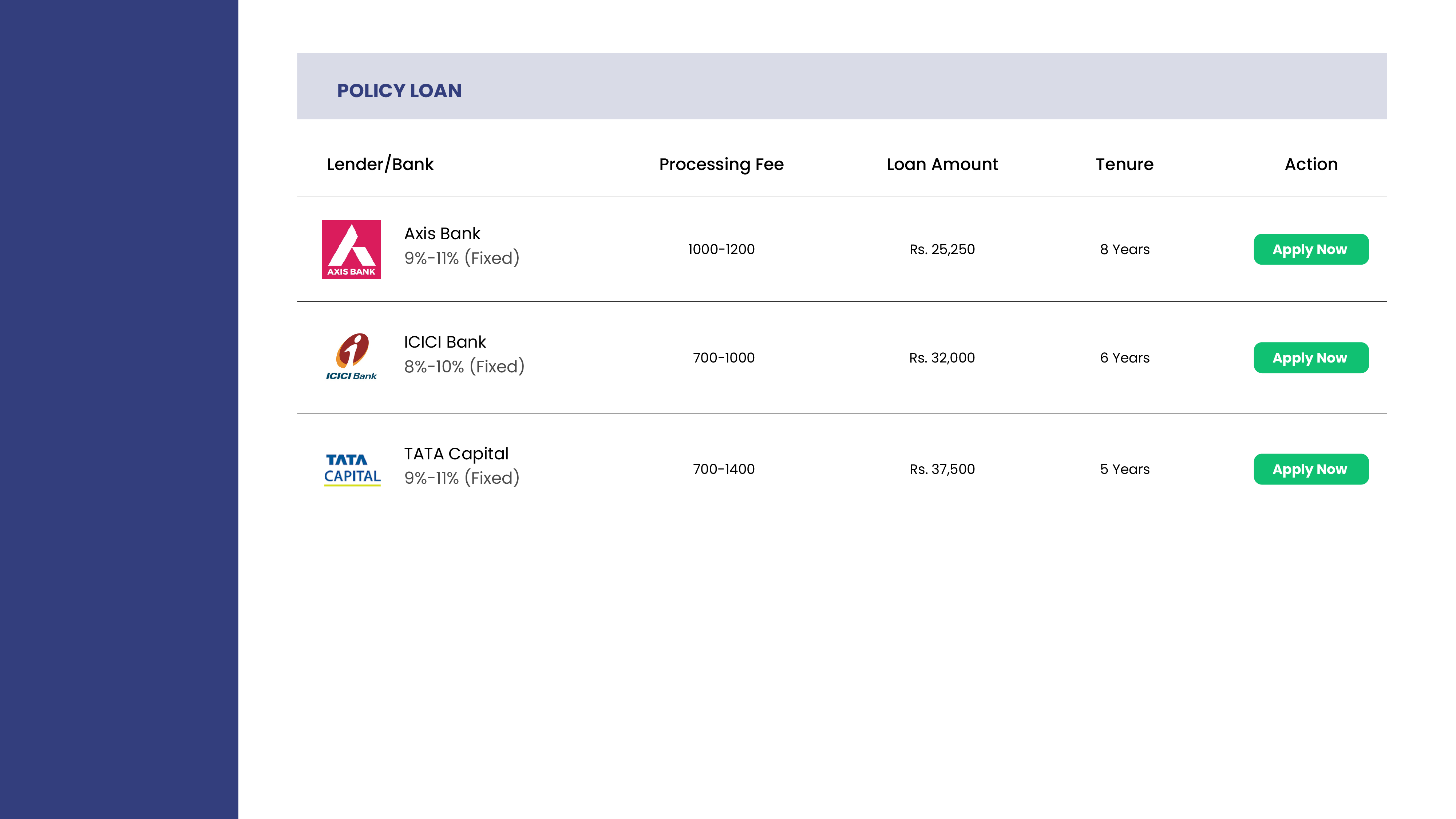

Policy Loan Marketplace

Solve short term emergency liquidity needs for customers, which is a deterrent to persistency and customers availing the long term benefits of the policy, especially in ULIPs

-

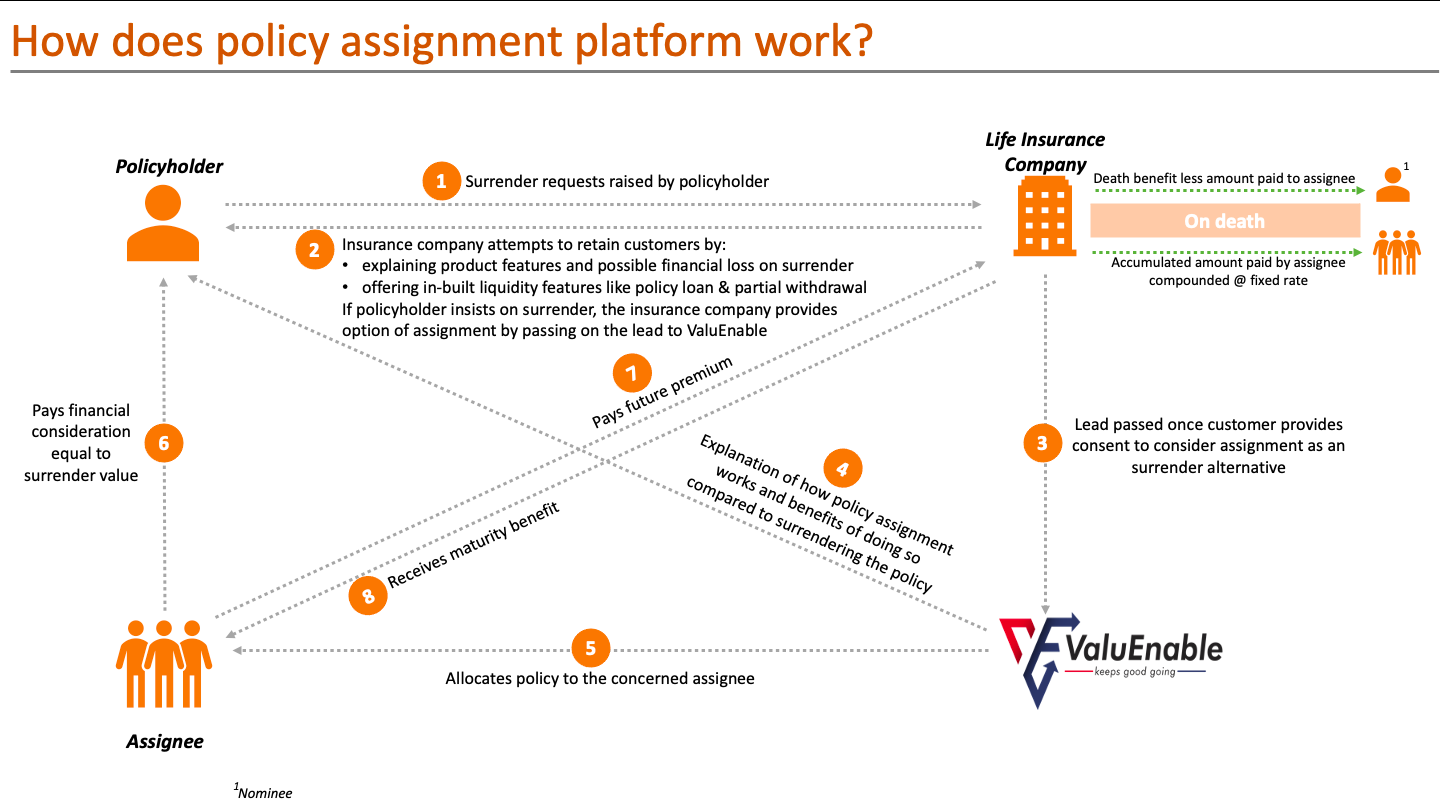

Policy Assignment Platform

An alternative to surrendering , wherein policyholders can continue their life cover while exiting the policy. Assignee (Institutional/HNI investors) get's an exposure to these policies through secondary route and pay future premiums to the insurers

...which enables value for all our

STAKEHOLDERS